Comprehensive Analysis of NEPSE Indicators of Shrawan 03

Market Overview

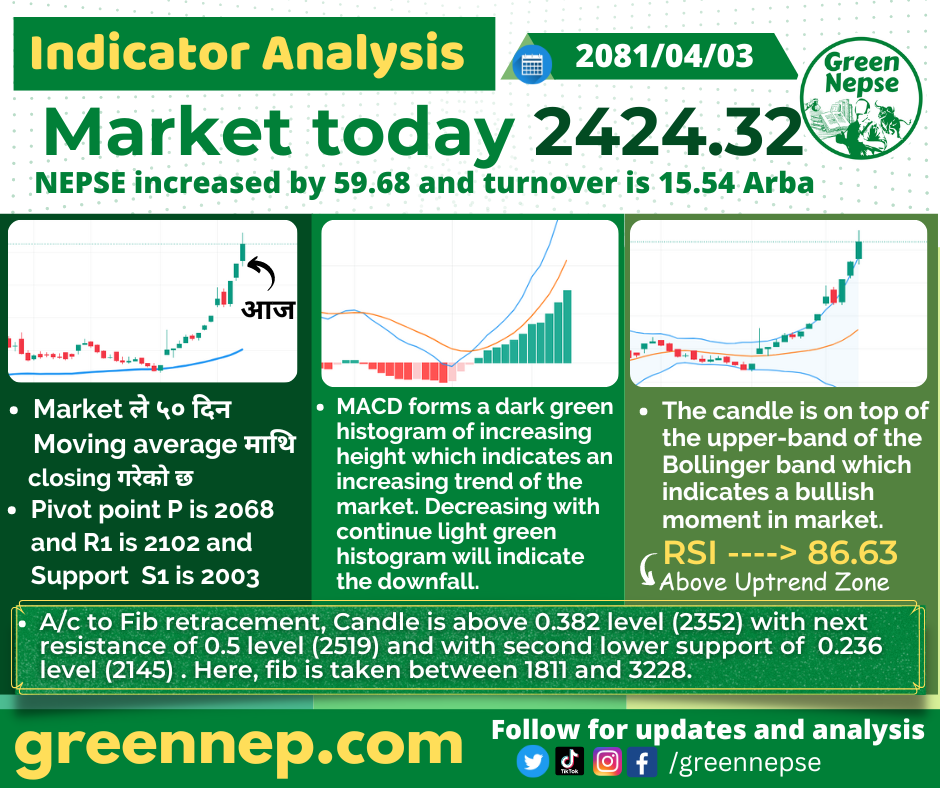

The NEPSE index has shown a notable increase today, closing at 2424.32, up by 59.68 points. The market turnover for the day stands at 15.54 Arba, indicating strong trading activity. This upward movement is reflected in several key technical indicators, suggesting a bullish trend.

Moving Averages

- 50-Day Moving Average: The market has closed above the 50-day moving average, which is a strong bullish signal. This suggests that recent prices are higher than the average price over the past 50 days.

Pivot Points

- Pivot Point (P): 2068

- Resistance (R1): 2102

- Support (S1): 2003

Today’s pivot point is at 2068, with the first level of resistance at 2102 and the first level of support at 2003. The market is currently well above the pivot point, indicating a strong upward trend.

MACD (Moving Average Convergence Divergence)

The MACD indicator shows a dark green histogram with increasing height, which suggests a strong upward trend in the market. However, if the histogram starts to decrease and turns light green, it may indicate a potential downturn.

Bollinger Bands

The candlestick is positioned on top of the upper band of the Bollinger Bands. This is typically a bullish signal, indicating that the market is experiencing higher volatility and is likely to continue in an upward direction.

Relative Strength Index (RSI)

The RSI value is at 86.63, placing it in the above uptrend zone. An RSI above 70 generally indicates that the market is overbought, but it also confirms the current bullish momentum.

Fibonacci Retracement

According to Fibonacci retracement levels:

- The current candle is above the 0.382 level (2352).

- The next resistance level is at the 0.5 level (2519).

- The lower support is at the 0.236 level (2145).

These levels are calculated based on the Fibonacci sequence, taken between the points 1811 and 3228. The fact that the market is above the 0.382 level suggests continued bullish behavior with the next target being the 0.5 level.

Conclusion

Today’s NEPSE indicator analysis by Green NEPSE highlights a strong bullish trend supported by various technical indicators such as moving averages, MACD, Bollinger Bands, RSI, and Fibonacci retracement levels. Investors can leverage this analysis to make informed decisions and capitalize on the upward momentum in the market.

For more detailed analysis and updates, visit Green NEPSE and stay ahead in your investment journey. Follow us on social media for real-time updates and insights.