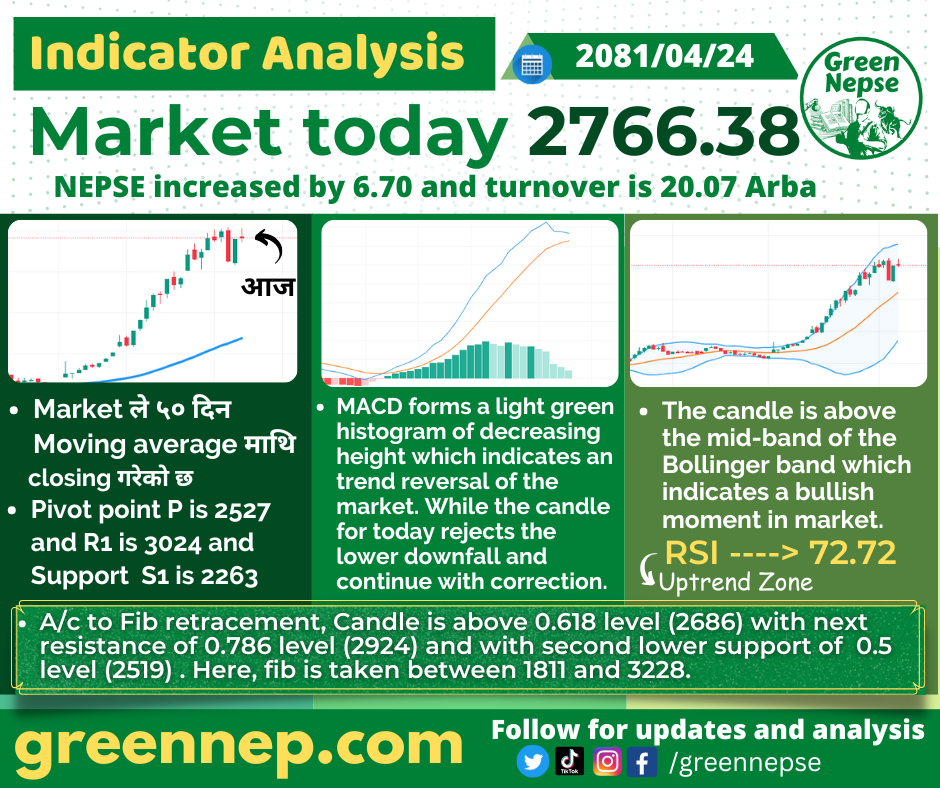

Comprehensive Analysis of NEPSE Indicators of Shrawan 24

Market Overview

The NEPSE index has shown a slight increase today, closing at 2766.38, which is an increase of 6.70 points. The market turnover for the day stands at 20.07 Arba. This comes after a period of volatility, where the market increased by 108.35 points yesterday, following a significant drop of 145.05 points the day before. The current movement suggests that the market is stabilizing and remains in a good position despite recent fluctuations.

Moving Averages

- 50-Day Moving Average: The market continues to close above the 50-day moving average, indicating sustained bullish momentum. This suggests that recent prices remain higher than the average price over the past 50 days, reinforcing the overall positive sentiment.

Pivot Points

- Pivot Point (P): 2527

- Resistance (R1): 3024

- Support (S1): 2263

Today’s pivot point is at 2527, with the first level of resistance at 3024 and the first level of support at 2263. The market’s current position above these levels continues to indicate an upward trend, though with caution due to recent volatility.

MACD (Moving Average Convergence Divergence)

The MACD indicator forms a light green histogram with decreasing height, indicating a potential reversal or correction in the market’s trend. Although today’s candle rejects the lower end of the range, it shows signs of a continued correction. Investors should monitor this closely as it could signal a shift in momentum.

Bollinger Bands

The candlestick is positioned above the mid-band of the Bollinger Bands, which generally indicates a bullish market. However, the slight correction observed suggests a potential consolidation phase before the market continues its upward trend.

Relative Strength Index (RSI)

The RSI value is at 72.72, placing it in the uptrend zone. An RSI above 70 generally indicates that the market is overbought, but it also confirms the ongoing bullish momentum. This suggests that the market could continue to perform well in the near term, despite recent fluctuations.

Fibonacci Retracement

According to Fibonacci retracement levels:

- The current candle is above the 0.618 level (2686).

- The next resistance level is at the 0.786 level (2924).

- The lower support is at the 0.5 level (2519).

These levels are calculated based on the Fibonacci sequence, taken between the points 1811 and 3228. The market’s position above the 0.618 level suggests a potential continuation of the upward trend, with resistance at 2924 being the next key level to watch.

Conclusion

Today’s NEPSE indicator analysis by Green NEPSE reflects a market that is stabilizing after recent volatility, with a slight increase indicating ongoing bullish momentum. The market remains in a good position, supported by various technical indicators such as moving averages, MACD, Bollinger Bands, RSI, and Fibonacci retracement levels. Investors are advised to stay vigilant and monitor market movements closely, especially considering the recent fluctuations.

For more detailed analysis and updates, visit Green NEPSE and stay ahead in your investment journey. Follow us on social media for real-time updates and insights.