Comprehensive Analysis of NEPSE Today -Indicators Review of Kartik 25 | Amazing Increment

Market Overview for Nepse Today – Kartik 25

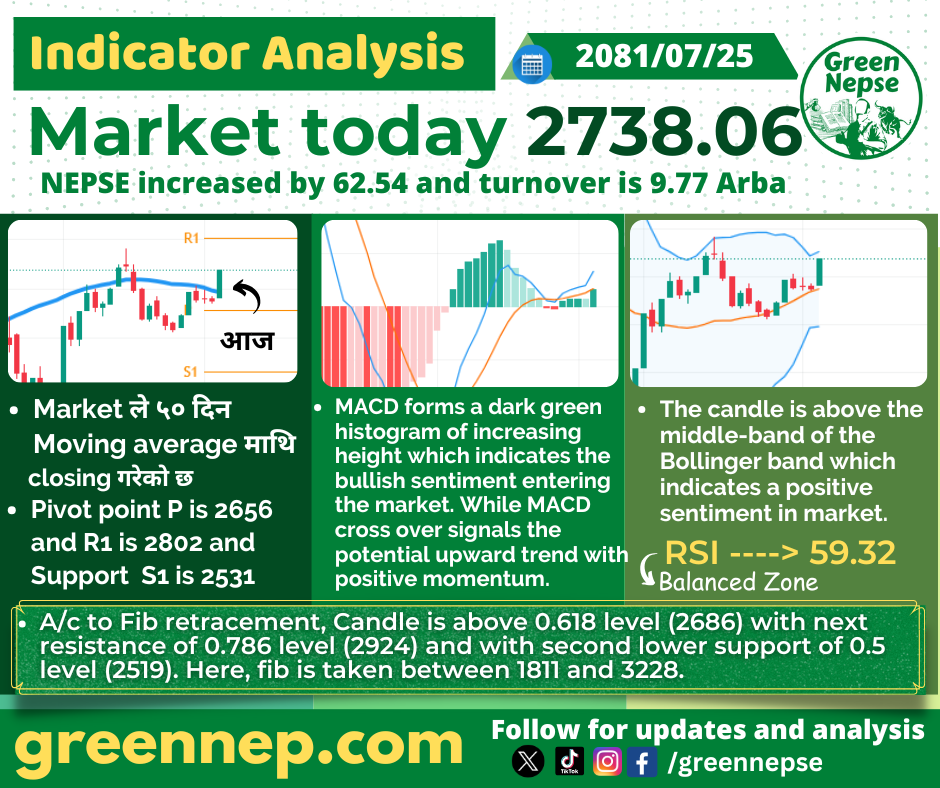

Today, on Kartik 25, the NEPSE index closed at 2738.06, reflecting a substantial increase of 62.54 points. The turnover reached 9.77 Arba, marking a higher trading volume compared to the previous days, indicating a surge in market activity and investor confidence.

Indicator Analysis

- 50-Day Moving Average: The market has closed above the 50-day moving average, suggesting a shift towards a more bullish sentiment. This breakthrough could indicate the beginning of a sustained uptrend if supported by continued trading volume.

- Pivot Points:

- Pivot Point (P): 2656

- Resistance (R1): 2802

- Support (S1): 2531 These levels provide crucial guidance for potential price movements, with the index currently positioned near its resistance.

- MACD (Moving Average Convergence Divergence):

- The MACD indicator has formed a dark green histogram with increasing height, signaling growing bullish momentum in the market. This trend indicates that positive sentiment is strengthening, which could drive further upward movement.

- The MACD line appears poised for a crossover above the signal line, which would confirm a shift to positive momentum if it holds in the coming days.

- Bollinger Bands:

- The candle has closed above the middle band of the Bollinger Bands, suggesting a positive market sentiment. This position within the bands often indicates potential for further gains if market conditions remain favorable.

- RSI (Relative Strength Index):

- The RSI is at 59.32, within the balanced zone but approaching the overbought threshold. This suggests strong buying pressure without yet reaching an overbought state, allowing room for further upward movement.

- Fibonacci Retracement:

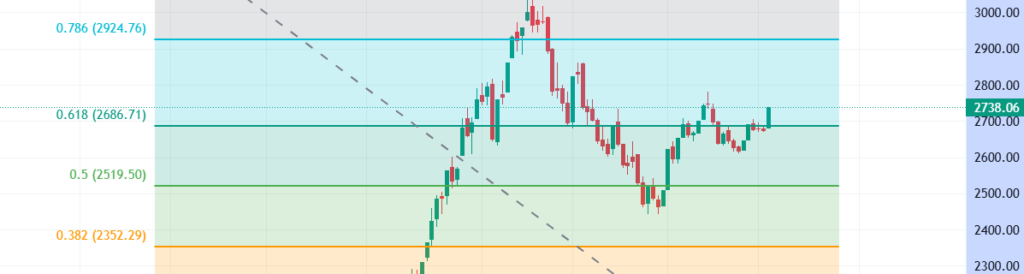

- Based on Fibonacci retracement levels, the candle is above the 0.618 level (2686) with the next resistance at the 0.786 level (2924). Support is currently positioned at the 0.5 level (2519). The Fibonacci levels are taken between 1811 and 3228, giving important levels for potential future support or resistance.

Summary

Today’s notable increase in both index value and turnover signals renewed investor enthusiasm and stronger buying momentum. With the NEPSE index above the 50-day moving average and the MACD histogram showing bullish indicators, the market outlook appears positive. However, traders should remain attentive to the RSI as it approaches overbought levels.

For daily updates and detailed market analysis, stay connected with Facebook Page GreenNepse.