BRICS Currency and the Push for De-Dollarization: The October Amazing Shift

In October 2024, the BRICS nations (Brazil, Russia, India, China, and South Africa) took another step towards reshaping the global financial landscape by advancing discussions on a new BRICS currency. This move is part of a broader push for de-dollarization, which aims to reduce global dependence on the US dollar and challenge its dominance in international trade.

The Context of De-Dollarization

Since the US dollar has been the main reserve currency of the globe for many years, the US wields considerable economic clout. Dollars are used for the majority of foreign transactions, particularly when dealing in commodities like oil. In addition to offering the United States a competitive edge in trade, its supremacy enables the imposition of financial penalties that have a significant effect on other countries. The BRICS nations have responded by speaking out more and more on the necessity of diversifying away from the currency.

October’s Key Developments

At a conference of BRICS finance ministers in October 2024, the discussion about creating a single BRICS currency took a new turn. The current BRICS president, South Africa, underlined how urgent it is to establish a more equitable global financial system. This follows Russia’s persistent efforts to dedollarize, which have been fueled in large part by the sanctions placed on it after the 2022 invasion of Ukraine.

A number of BRICS countries have confirmed their intention to investigate a new BRICS currency. In areas where these countries have significant influence, such as commodities like gold or energy resources like oil and gas, this prospective currency might be based on a basket of BRICS currencies. In order to lessen member states’ susceptibility to American financial limitations and economic policies, a more robust and stable global currency would enable countries to trade with one another without depending on the dollar.

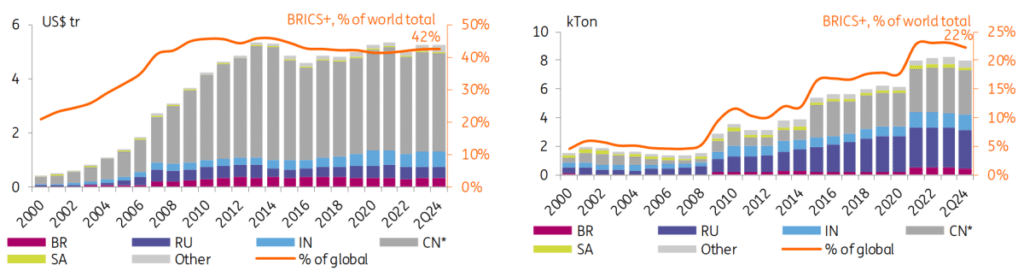

FX and gold reserves of BRICS+ central banks, e.o.p.

Implications for the Global Economy

A BRICS currency might have a big impact on the world financial system if it is introduced successfully. It might cause trade patterns to change as countries decide to use the BRICS currency more frequently, undermining the dominance of the US dollar. Additionally, nations outside of the BRICS bloc may use this new currency to lessen their reliance on the dollar or to get under US sanctions.

A BRICS currency might have a big impact on the world financial system if it is introduced successfully. It might cause trade patterns to change as countries decide to use the BRICS currency more frequently, undermining the dominance of the US dollar. Additionally, nations outside of the BRICS bloc may use this new currency to lessen their reliance on the dollar or to get under US sanctions.

How would a new BRICS currency affect the US dollar?

A new BRICS currency could have several significant effects on the US dollar, particularly in terms of its global dominance and economic influence. Here’s how:

- The decline of the dollar’s dominance in commerce

In international trade, the US dollar has long held a strong position, particularly when it comes to commodities like gas and oil. A BRICS currency might incentivize member countries – and possibly other nations – to use the new currency for more commerce, particularly inside the BRICS bloc. As a result, less international trade would be carried out in dollars, progressively undermining its hegemony. - Decreased Demand for the Dollar

Due to its role in international trade and as a reserve currency maintained by central banks, the US dollar is in high demand worldwide. There might be less need for nations to keep sizable quantities of US dollars in reserves if a BRICS currency takes off, which would lower demand. The dollar’s value in relation to other currencies may decline if demand for it declines. - Challenges to US Economic Influence

- Potential Impact on U.S. Borrowing Costs

- Volatility in Global Markets

- Impact on U.S. Monetary Policy

Overall, a BRICS currency could reduce the US dollar’s global influence, especially in trade and geopolitics. However, it’s important to note that such a change would likely be gradual, as the US dollar’s deep entrenchment in the global economy makes it difficult to displace.

Conclusion

In conclusion, the creation of a new BRICS currency represents a pivotal step toward reshaping the global financial order and reducing the over-reliance on the US dollar. As the BRICS nations grow in economic influence, the dominance of the dollar in international trade and finance has become increasingly problematic, especially for countries facing U.S. sanctions or economic challenges tied to dollar volatility.

A BRICS currency could provide a much-needed alternative that promotes more balanced global trade, reduces vulnerability to U.S. monetary policies, and fosters greater financial autonomy for emerging economies. While the road to creating such a currency will be complex, the necessity for a more diversified, resilient, and equitable global financial system is clear. The BRICS initiative, by pushing for de-dollarization, is a vital step toward addressing these global imbalances and creating a more inclusive economic future for all.